Assalam Alaikum, Sindh Port of Revenue has announced the latest glass bandh, which was advertised on 1 November 2024. If you are interested in these jobs, you can check about them on our website Jobs Spots. Full information will be given in these jobs, and both men and women can apply.

Candidates who are interested in Port of Revenue have to provide necessary documents along with a CNIC copy of current or passport-size photographs and a detailed. All the shortlisted candidates will be called for an interview.

Before applying for the Sindh Board of Renewal, you must read about these jobs thoroughly to apply for them. If you are eligible according to their requirements, then apply to them.

Table of Contents

Detail Of Jobs In Sindh Board Of Revenue 2024

| Post Date | 01-11-2024 |

| Industry | Sindh Board Of Revenue |

| Jobs Location | Sindh Pakistan |

| Hiring Organization | Sindh Board Of Revenue |

| Last Date | 11-11-2024 |

| Education Require | Bachelors |

| No of Posts | 50+ |

| Employment Type | Full Time |

| News Papers | Express and Dawn Newspaper |

| Address | Sindh, Pakistan |

Eligibility Criteria For Jobs In Sindh Board Of Revenue 2024

| Education Required | Bachelor |

| Age | 21 to 30 Years |

| Gender | Male| Female |

| Province/District | Sindh Pakistan |

| Experience | Fresh |

Posts Available In Jobs In Sindh Board Of Revenue 2024

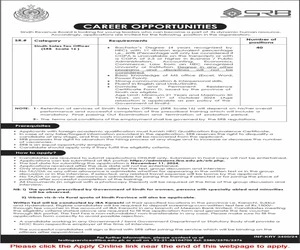

- Sindh Sales Tax Officer

How to Apply For Jobs In Sindh Board Of Revenue 2024

- To apply for these posts you have to visit the IBA website.

- The last date to apply is 11 November 2024.

- Applications that are received after the due date will not be entertained.

- Only shortlisted candidates will be called for tests group discussions and interviews.

- Selected candidates will be sent for training and those who successfully complete the training will receive postings.

Apply For Online Jobs In Sindh Board Of Revenue 2024

Friends, to apply to the Sindh Board of Revenue, you have to go to the job portal of IBA. Go to the job portal and you will receive a challan from there. After that IBA will give you the date of the interview and test after which you can give your interview and test. Only those candidates will be eligible for short interviews whose eligibility criteria are IBA. will be per the standard of IBA.

You don’t need to send documents anywhere to apply for these jobs, you can apply through IBA’s Online Only.

FAQS About Jobs In Sindh Board Of Revenue 2024

Here are short FAQs about the Sindh Board of Revenue job announcement:

- Who can apply for jobs at the Sindh Board of Revenue? Both men and women meeting the eligibility criteria can apply for these positions.

- What documents are required for the application? Applicants need to provide a copy of their NIC, passport-size photos, and a detailed CV.

- How can I apply for the Sindh Board of Revenue jobs? Applications can be submitted online through the IBA job portal by 11 November 2024.

- What is the selection process for these jobs? Shortlisted candidates will be called for tests, group discussions, and interviews.

- Is previous experience required for these positions? No, fresh graduates with a Bachelor’s degree are eligible to apply.

Advertisement Of Jobs In Sindh Board Of Revenue 2024

About Sindh Board Of Revenue

The Sindh Board of Revenue (BOR) is a government body responsible for the administration and regulation of revenue collection, land management, and related functions within the province of Sindh, Pakistan. This organization plays a critical role in overseeing land records, managing tax collections, and ensuring the implementation of revenue laws in the province. Below is a detailed overview of its structure, functions, and key responsibilities.

1. History and Establishment

The Sindh Board of Revenue traces its roots to colonial times when British authorities introduced formal land and revenue administration in India. The system established during this period laid the groundwork for modern land revenue collection and management practices. Following the independence of Pakistan in 1947 and the subsequent creation of Sindh as a province, the Board of Revenue was established to continue and enhance the revenue functions in the region.

2. Structure and Organization

The Sindh Board of Revenue operates under the Revenue Department of Sindh and is headed by a Senior Member Board of Revenue (SMBR), who oversees its various operations and divisions. The organization includes several departments, each responsible for specific functions such as land revenue, estate management, and taxation. Key positions and departments include:

- Senior Member (SMBR): The highest-ranking official, responsible for policy oversight and administrative control.

- Commissioners: Responsible for managing districts within their respective divisions and implementing revenue policies.

- Deputy Commissioners: Oversee revenue collection, land records, and local administrative functions within districts.

- Assistant Commissioners: Assist the Deputy Commissioners in revenue collection and record management.

- Tehsildars and Patwaris: Work at the grassroots level to maintain land records and interact directly with the public.

3. Core Functions of the Sindh Board of Revenue

The Sindh Board of Revenue has several primary responsibilities that cover a broad spectrum of land management and revenue administration:

i. Revenue Collection

The BOR is tasked with collecting various types of revenues for the Sindh provincial government, which include land revenue, agricultural taxes, stamp duties, and registration fees. These funds are essential for financing government projects, infrastructure development, and public services across the province.

ii. Land Records Management

A critical role of the Board of Revenue is to maintain and update land records for accurate property ownership and transfer documentation. The BOR has initiated several projects to digitize land records, making them more accessible and secure. This ensures transparency, reduces disputes, and minimizes corruption associated with manual record-keeping.

iii. Property Registration and Mutation

The BOR oversees the registration of property transactions, ensuring that ownership transfers are recorded accurately. This function includes managing mutations (changes in land records due to inheritance or sale), lease agreements, and other property-related transactions.

iv. Revenue Court System

The Sindh Board of Revenue also operates a system of revenue courts where land-related disputes are resolved. These courts provide a legal avenue for individuals and entities to resolve issues related to property ownership, boundary disputes, inheritance claims, and other land matters.

v. Natural Disaster Management

The BOR plays a role in managing land and resources during natural disasters such as floods, earthquakes, and droughts. The department may assist in rehabilitating affected areas, compensating affected landowners, and coordinating relief efforts with other government agencies.

vi. Policy Development and Implementation

The BOR helps develop policies for efficient revenue collection, land management, and taxation. This involves working with other governmental departments, including the Finance Department, the Planning and Development Department, and the Agriculture Department, to create policies that align with the province’s developmental goals.

4. Key Initiatives and Reforms

Over recent years, the Sindh Board of Revenue has introduced several reforms aimed at improving transparency, efficiency, and accessibility of services:

- Land Record Digitization: One of the major reforms is the computerization of land records, which aims to reduce manual errors and corruption. This project involves creating a digital database where land ownership and property boundaries are recorded electronically.

- Sindh Revenue Automation: In collaboration with the Sindh Revenue Board (SRB), the BOR has implemented automated systems to streamline revenue collection and management.

- E-Registration and Online Services: To reduce the need for physical visits, the BOR has introduced online services for property registration, tax payments, and document verification.

5. Challenges Faced by the Sindh Board of Revenue

Despite its significant role, the Sindh Board of Revenue faces several challenges:

- Corruption and Bureaucratic Red Tape: Like many revenue departments, the BOR is susceptible to corruption and bureaucratic delays, which can hinder service delivery and damage public trust.

- Inefficient Record Management: Despite ongoing digitization, many land records remain in paper form, increasing the risk of tampering, loss, and disputes.

- Resource Constraints: Limited financial and human resources make it challenging to implement widespread reforms and provide services efficiently.

- Legal Complications: The BOR frequently deals with complex legal issues involving land disputes and inheritance claims, which can take years to resolve.

6. Public Services Provided by the Sindh Board of Revenue

The BOR offers several public-facing services to facilitate easier interactions for citizens:

- Land Ownership Verification: Citizens can verify land ownership and property details, often through online portals or designated offices.

- Tax Payment and Receipts: Individuals and businesses can pay their land taxes, agricultural taxes, and other dues to the Board of Revenue.

- Certified Copy of Land Records: The BOR provides certified copies of land records, which are essential for legal and financial transactions.

- Guidance on Property Registration and Transfer: BOR officials assist citizens in navigating the processes of property registration, transfer, and mutation.

7. Significance of the Sindh Board of Revenue

The Sindh Board of Revenue is essential to Sindh’s economic health, social stability, and infrastructure development. By overseeing land administration, the BOR helps maintain property rights and enables efficient tax collection, which funds critical provincial projects and services.

I am Tayab Aftab, I do apply for jobs online, that’s my hobby and I will post on my website for you those advertisements, you can contact me on my WhatsApp or you can email me for any type of query regarding the advertisement. I will help you to apply for those jobs.