Hello everyone, the latest jobs have been announced by the FBR (Federal Board of Revenue), which was advertised in the Dawn newspaper on June 27, 2025. If you are interested in FBR (Federal Board of Revenue) jobs, then you have come to the right place. Here you will get complete information about FBR (Federal Board of Revenue) jobs.

Before applying for FBR jobs, read and understand the information given below carefully, and only then apply. You have been given the information below and understand it correctly. Check whether you meet the criteria for these jobs or not. If you do, then apply now without waiting for the last date.

FBR jobs will be based on merit. Any candidate who meets the merit will be able to get job in Pakistan in 2025. These jobs are for both men and women. All candidates who belong to Pakistan are eligible for these jobs. First, read the information given below correctly. It is written in it that those who live in Pakistan are eligible. Then read the information given below correctly, and then apply.

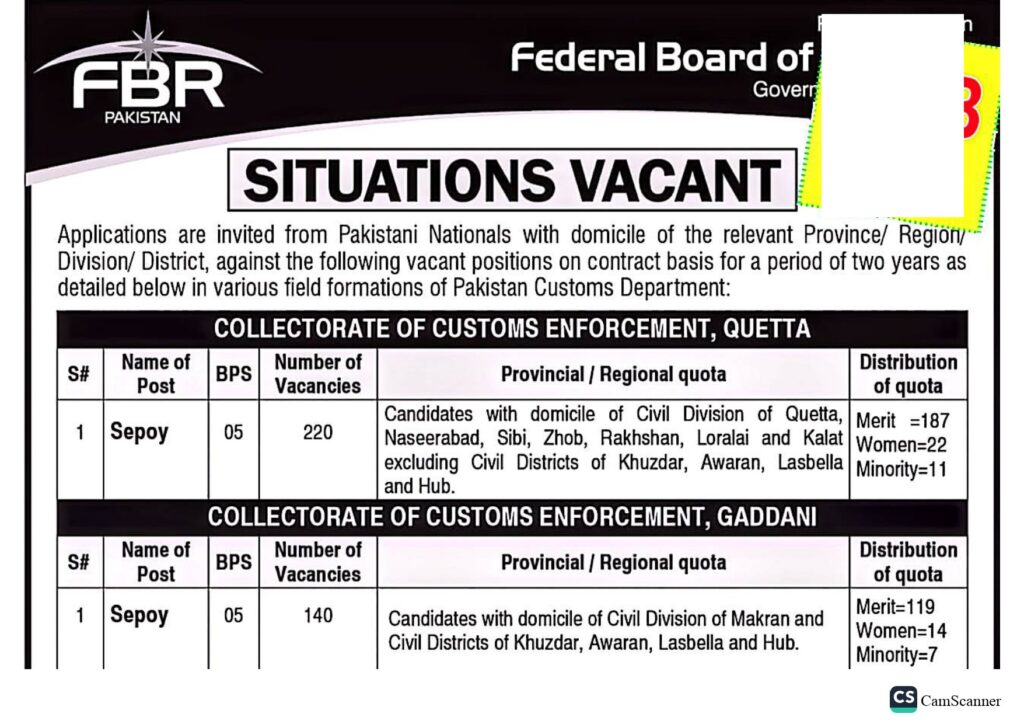

Details of FBR (Federal Board of Revenue) Jobs

| Post Date | 27-06-2025 |

| Industry | Government |

| Jobs Location | Pakistan |

| Hiring Organization | FBR (Federal Board of Revenue) Jobs |

| Last Date | 15-07-2025 |

| Education Require | Primary, Matric, Intermediate |

| No of Posts | 2000+ |

| Employment Type | Full Time |

| News Papers | DAWN newspaper |

| Address | FBR (Federal Board of Revenue) Jobs, Pakistan |

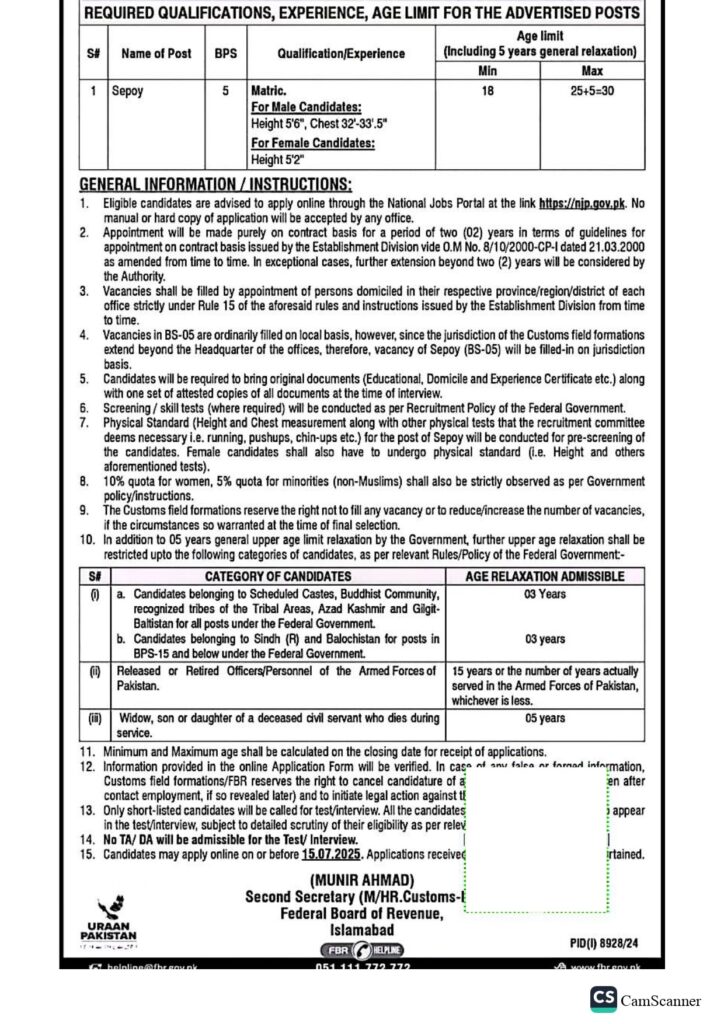

Eligibility Criteria for FBR (Federal Board of Revenue) Jobs

To apply for these jobs, you must meet the following conditions:

- Nationality: Pakistani

- Age: Minimum 18 years, Maximum 30 years (5 years general age relaxation included)

- Education:

- Sepoy: Matric pass

- Driver: Primary pass with a valid driving license and driving experience

- Naib Qasid: Primary pass

- Physical Requirements for Sepoy:

- Male: Height 5’6”, Chest 32”-33.5”

- Female: Height 5’2”

- Physical Test: Walking and running are required

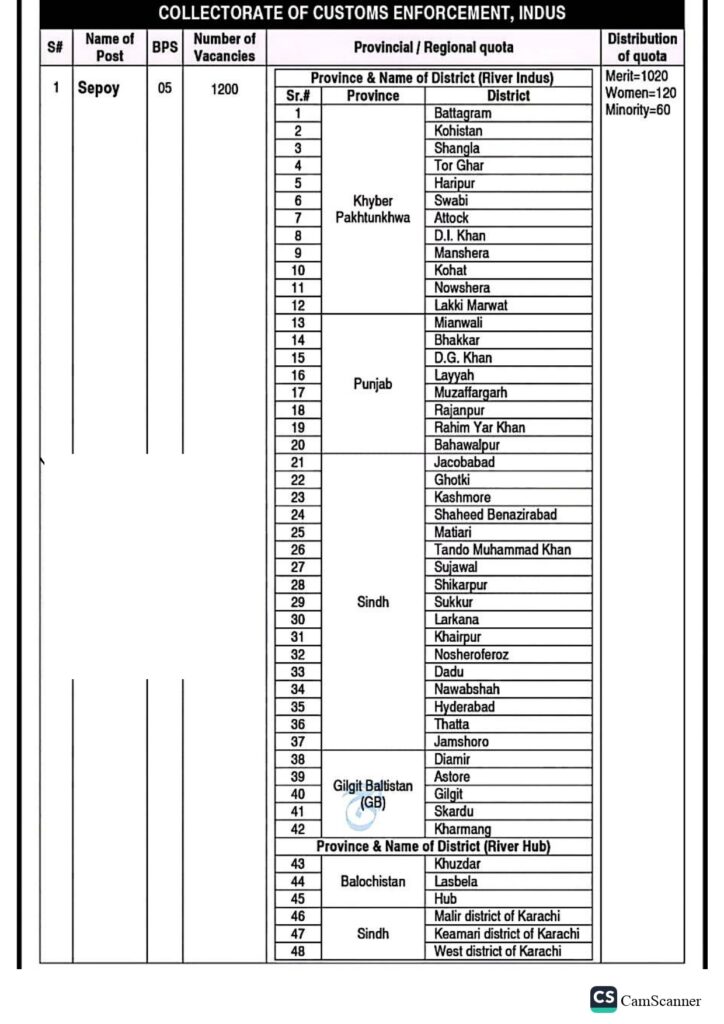

FBR Job Locations (All Provinces)

The FBR jobs are available in the following provinces and cities:

- Punjab – Lahore, Multan, Rawalpindi, etc.

- Sindh – Karachi, Hyderabad, Sukkur

- KPK – Peshawar, Abbottabad

- Balochistan – Quetta, Turbat

- Federal – Islamabad

Available Posts with Details of FBR (Federal Board of Revenue) Jobs

Here is a simple table showing the names of the jobs, grade (BPS), required qualifications, and where they are available.

| Post Name | BPS | Education | Posting Locations |

|---|---|---|---|

| Sepoy | BPS-05 | Matric | Karachi, Lahore, Peshawar, etc. |

| Driver | BPS-04 | Primary + Driving License | All over Pakistan |

| Naib Qasid | BPS-01 | Primary | Karachi, Lahore, Peshawar, and other cities. |

How to Apply for FBR (Federal Board of Revenue) Jobs

It’s very easy to apply. Just follow these steps:

1. Download the Application Form

There is no online form. You have to manually write or print your application as per the job ad instructions.

2. Prepare Documents

Attach the following documents with your application:

- Attested copy of CNIC

- Educational certificates

- Domicile

- 2 passport-size photos

- Experience certificate (if any)

- Driving License (for driver post)

3. Write a Clear Job Title

On the envelope, include the Post Name and your desired city or location.

4. Send Your Application

Post the application to the relevant FBR office (as mentioned in the ad). Each job location has a separate address.

5. Deadline

Submit your application within 15 days of the advertisement being published in the newspaper.

Important Notes and Instructions

- Only shortlisted candidates will be called for the test/interview.

- No TA/DA will be given for appearing in the test or interview.

- You must bring original documents at the time of the interview.

- Late or incomplete applications will not be accepted.

- Separate application forms are required if applying for more than one post.

- Women, minorities, and disabled persons are encouraged to apply under the reserved quota.

Advertisement for FBR (Federal Board of Revenue) Jobs

Online Application for FBR (Federal Board of Revenue) Jobs

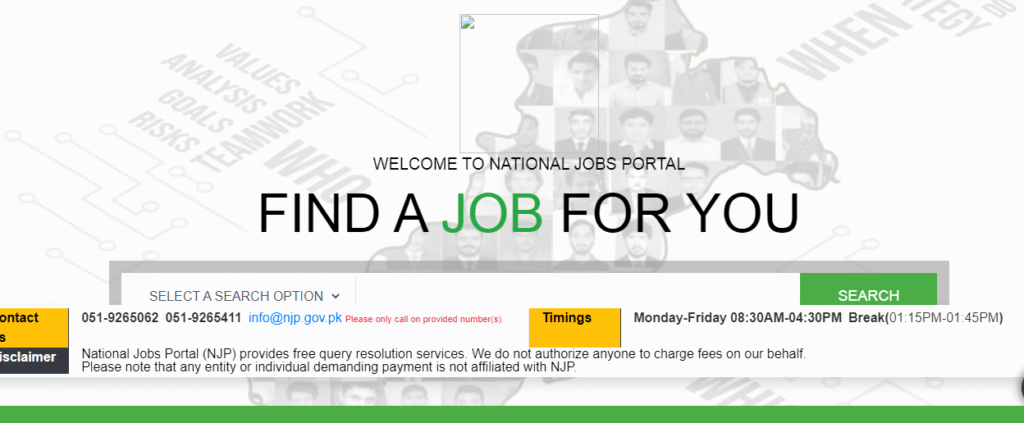

The procedure for applying online for FBR (Federal Board of Revenue) jobs is that you will go to the official website of NJP www.njp.gov.pk, by going there you will create your account, in the account you will have to provide personal information and your Gmail information, after which your account will be created, after creating the account you will go to the career section, there you will see jobs, as it is showing you the picture below, you have to apply in the same way.

In FBR jobs, select whichever post you want to apply for, and then the application form will open. After filling it correctly, press the submit button, then your application will be done. There is no challan fee for this. If you still do not understand anything, then contact me. Insha Allah, your problem will be solved, whatever it may be.

Frequently Asked Questions (FAQs) FBR (Federal Board of Revenue) Jobs

Q1. Can I apply online for FBR jobs?

No. You have to apply through manual submission by post.

Q2. I am 17 years old. Can I apply?

No. The minimum age is 18 years.

Q3. Is there any fee to apply?

No. There is no application fee mentioned.

Q4. Can women apply?

Yes. Women are encouraged to apply and have a reserved quota.

Q5. Is experience necessary?

Only for the driver post, you must have a valid license and some driving experience.

About FBR (Federal Board of Revenue)

When we think about taxes in Pakistan, the first name that comes to mind is the Federal Board of Revenue, more commonly known as FBR. But what exactly does this organization do? Why is it such a crucial part of Pakistan’s economy and governance?

The FBR is Pakistan’s premier tax collection agency, responsible for ensuring that the country earns the revenue it needs to function. From building roads to running schools, almost every government activity depends on taxes, and FBR makes sure those taxes are collected.

🏛️ History of FBR

Establishment and Early Years

The roots of FBR go all the way back to 1924, when it was established as the Central Board of Revenue (CBR) under the British Raj. At that time, its main purpose was to manage customs and central excise duties.

Evolution Over the Decades

After Pakistan’s independence in 1947, CBR was adapted into the Pakistani system. With growing economic demands and evolving governance, the board underwent several structural reforms over the decades.

Transformation to FBR

In 2007, the CBR was restructured and renamed the Federal Board of Revenue. This change wasn’t just in name—it represented a push towards modernization, automation, and transparency.

🎯 Mission and Vision of FBR

Mission Statement

“To enhance the capability of the tax system to collect due taxes through the application of modern techniques, providing taxpayer-friendly services, and promoting a compliance culture.”

Vision for the Future

The FBR aims to become a fully digital, transparent, and efficient organization that ensures voluntary tax compliance, reduces evasion, and supports the economic stability of Pakistan.

🏢 Organizational Structure of FBR

Board of Directors

The FBR is headed by a Chairman, who is usually a senior bureaucrat from the Pakistan Administrative Service. The board is further composed of Members handling various divisions such as Inland Revenue, Customs, Legal Affairs, and HR.

RTOs and LTUs

FBR operates across Pakistan through Regional Tax Offices (RTOs) and Large Taxpayer Units (LTUs), which handle individuals and businesses, ensuring nationwide tax collection.

📋 Functions and Responsibilities of FBR

Tax Collection

FBR collects:

- Income Tax

- Sales Tax

- Customs Duty

- Federal Excise Duty

Policy Making

FBR not only collects taxes, it also creates and enforces tax policy as directed by the Ministry of Finance.

Customs and Border Duties

It regulates imports and exports, levies customs, and enforces border security to control illegal trade.

Investigation and Enforcement

FBR’s intelligence units track down tax evaders, conduct audits, and investigate suspicious financial activity.

🏢 Key Departments Under FBR

Inland Revenue Department (IRD)

Handles:

- Income tax

- Sales tax

- Federal excise duty

Customs Department

Manages:

- Customs laws

- Import-export regulations

Directorate General of Intelligence & Investigation

Focuses on:

- Financial fraud

- Money laundering

- Tax evasion

🌐 Digital Transformation and E-Governance

FBR has taken a big leap towards digitalization:

- IRIS System: Online platform for return filing.

- Taxpayer Profiling: Check your profile via CNIC.

- FBR App: For checking NTN, filing taxes, and accessing support.

💰 FBR’s Role in the Economy

FBR is the lifeline of Pakistan’s economy. In FY 2023–24, it collected trillions in taxes, helping fund defense, education, and public welfare.

- FBR contributes over 85% of the total revenue.

- Helps in balancing the budget deficit.

- Influences monetary policy and inflation indirectly.

🔁 Tax Reforms and Initiatives

FBR has taken multiple steps to improve tax collection:

- Asset Declaration Schemes: Encouraging people to declare hidden wealth.

- Tracking Non-Filers: Using NADRA, electricity bills, and vehicle records.

- Simplified Tax Filing: IRIS and e-filing system.

- Real-Time POS Integration: Retail sales tracking via point-of-sale terminals.

🚧 Challenges Faced by FBR

FBR’s job isn’t easy. Major challenges include:

- Tax Evasion: Billions lost every year.

- Corruption: Internal corruption damages trust.

- Public Mistrust: Many see FBR as harsh and bureaucratic.

🏭 FBR and the Business Community

FBR plays a big role in shaping business growth:

- SMEs: Efforts to make tax filing easier.

- Large Corporations: Monitored under LTUs.

- Tax Holidays: Offered to startups and new industries.

📰 Recent Developments in FBR

- Budget 2024-25 introduces new wealth taxes and increased sales tax slabs.

- IMF conditions required stricter compliance and more aggressive tax audits.

- FBR recently launched a Whistleblower Reward Program.

🚀 Future Plans of FBR

Looking forward, FBR aims to:

- Use AI for risk profiling.

- Expand digital services and data analytics.

- Improve customer care centers and taxpayer facilitation.

📢 Public Awareness and Outreach

FBR regularly appears on:

- TV & radio advertisements.

- Social media campaigns.

- School & college seminars about tax literacy.

I am Tayab Aftab, I do apply for jobs online, that’s my hobby and I will post on my website for you those advertisements, you can contact me on my WhatsApp or you can email me for any type of query regarding the advertisement. I will help you to apply for those jobs.